Fiscal policy

3-6-17

Fiscal policy: Congress action to control government changes in the expenditures or tax revenues of federal government

2 tools of fiscal policy

- Taxes - government can increase or decrease taxes

- Spending - government can increase or decrease spending

Fiscal policy was enacted to promote our nation's economic goals: full employment, price stability, economic growth

Deficits, surpluses, budgets

- Balanced budget: revenues = expenditures

- Budget deficit: revenue < expenditures

- Budget surplus: revenues > expenditures

Government debt: sum of all deficits - sum of all surpluses

Government borrows money from:

- Individuals

- Corporations

- financial institutions

- foreign entities or governments

Options of fiscal policy

- Discretionary fiscal policy (think deficit)

- Contractionary fiscal policy (think Surplus)

- non-discretionary fiscal policy (no action)

Three types of taxes

- Progressive taxes are taxes that take larger percent of income from high-income groups

- Proportional taxes or flat rates take some percent of income from all income groups

- Regressive taxes text larger percent from low-income groups

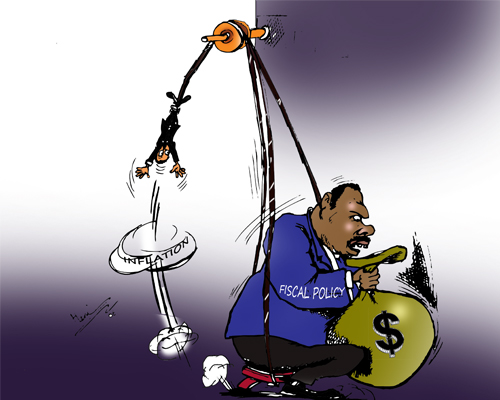

Contractionary fiscal policy (the brake)

- Laws that reduce inflation, decrease GDP (close inflation gap)

- Government spending decrease

- tax increase

- Combination of the two

Expansionary fiscal policy (the gas)

- Laws that reduce unemployment and increase GDP (close recession gap)

- Increase government spending

- decrease taxes

Automatic / built-in stabilizers

- Anything that increases government budget deficit during a recession and increases its budget surplus during inflation without requiring explicit action by policy makers

No comments:

Post a Comment