Learn More about Unemployment and working in the Economy

http://playspent.org/

You do not have to donate

Monday, February 13, 2017

Calculating GDP

Important Formulas to Know

- GDP = C + I + G + Xn: The expenditure approach

- GDP = W (wages) + R (rental income) + I (interest income) + P (profits) + S (statistical adjustment): The income approach

- Budget Surplus/ Deficit : gov. purchases + gov transfer payments - gov tax collection

- Trade Surplus/ Defecit; Exports- Imports

- National Income : (Compensation of employees + rental income + interest income + Proprietors income + corporate profits) or (GDP - indirect business taxes - depreciation - net foreign Factor payment )

- Disposable personal Income: National income - personal household taxes + government transfer payments

- Net Domestic product : GDP- Depreciation

- Net national Product: GNP - depreciation

- Gross Investment: Net Investment + depreciation

Depreciation: loss of value in capital equipment due to normal wear and tear

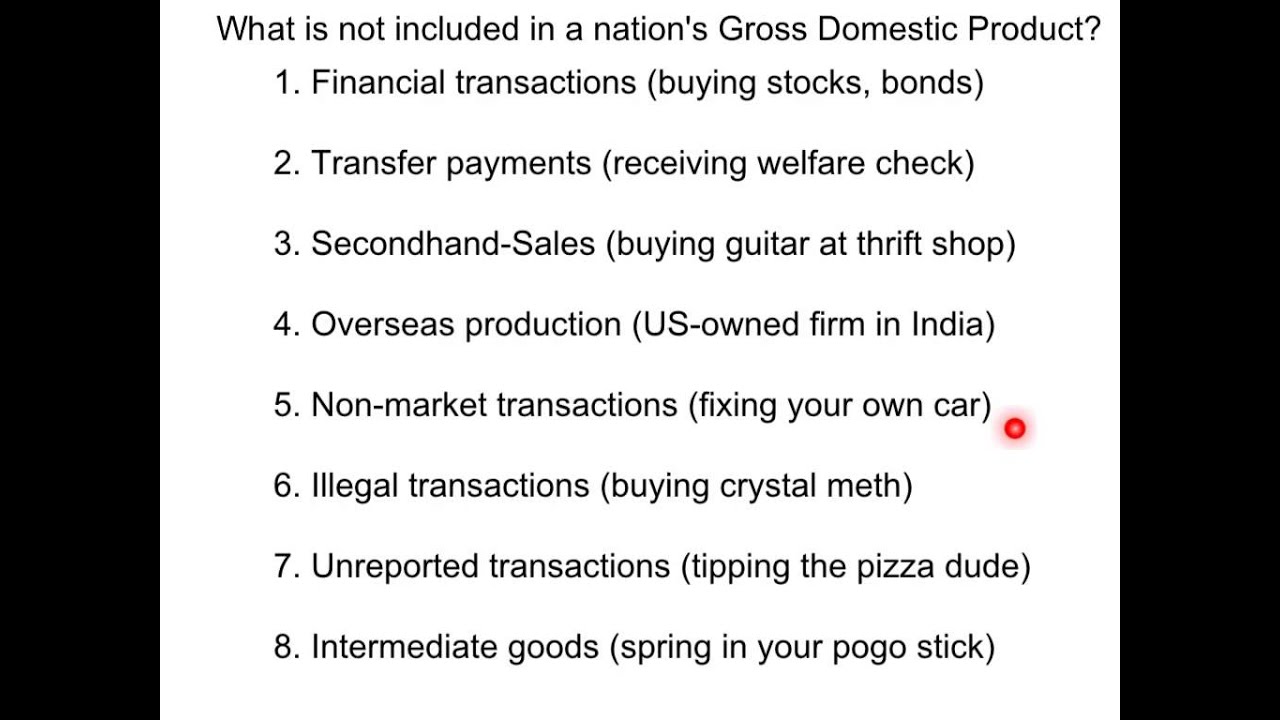

Included and Excluded in GDP

Included in GDP

Consumer Spending (C)

Gross Private Investment Spending (IG)

Government Spending (G)

Net Exports (XN)

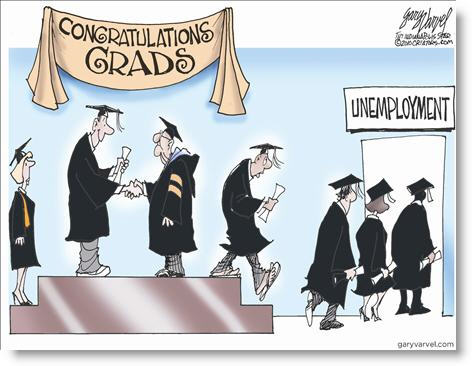

Unemployment

February 9 2017

- Unemployment is the percent of people in labor force want a job but are not working

- Labor force = unemployed + employed

Considered employed

- Work at least one hour per month

- Temporarily absent from work

- Part time workers

Not in labor force

- Children

- Full-time students

- Those in mental institution

- Those incarcerated

- Retirees

- Suzy homemakers or stay-at-home parents

- Military personnel

- Those discouraged psychologically/mentally

Formula for unemployment rate = # of unemployed / total labor force x 100

- 4 to 5% = standard unemployment

Four types of unemployment

- Frictional unemployment or temporary unemployment: “in between jobs”. Qualified workers with transferable skills but aren't working.

- ex: high school/college students looking for a job

- Seasonal unemployment: specific type of frictional unemployment due to time of year and the nature of job

- Ex: Santa Claus/Easter bunny impersonators

- Structural unemployment: changes structure of labor force, makes some skills obsolete. Workers do not have transferable skills. Permanent loss of these jobs is called creative destruction.

- Cyclical unemployment: unemployment that results from economic downturns/recession.

- As demand for goods and services falls, demand for labor falls and workers are fired.

Two types of three unemployment are unavoidable

- Frictional

- Structural

- Together they make up the natural rates of unemployment (NRU). We are at full employment if we have only the NRU.

Frictional + structural = NRU ( 4-5%) - full employment

- Full employment means no cyclical unemployment

- Okuns Law: When unemployment rises 1% above the natural rate, GDP falls by about 2%

Inflation

February 6 2017

Inflation

- Inflation is a general rise in price level

- It reduces the purchasing power of money

- Purchasing power is the amount of goods and services that money buys

- Ex: it takes two dollars to buy today what one dollar buy in 1982

- The ideal inflation rate is 2 - 3%

3 causes of Inflation

- Printing too much money

- Demand- pull inflation (demand pulls up prices)

- Demand increases but supply stays the same. The result is a shortage driving prices up.

- Cost-push inflation

- Higher production costs increases prices

Inflation formula = current year price index - base year price index / base year price index x 100

Deflation: decline in general price level

- Disinflation occurs when inflation rate itself the declines

- The rule of 70 is used to calculate the number of years it will take for the price level to double at any given rate of inflation.

- Formula = 70 / annual rate of inflation

- Real interest rate: amount of money borrowed. % increase in purchasing power. (adjusted for inflation)

- Formula: nominal interest rate - expected inflation

- Nominal interest rate: percent increase in money that borrowers pay back to the lender (not adjusting for inflation)

Hurt about inflation

- Lenders - people who loan out money at fixed interest rates

- Savers

- People with fixed incomes

Helped by Inflation

- Borrowers - people borrow money

- A business where the price of the product increases faster than the price of resources

Nominal and Real GDP

February 3, 2017

Nominal and real GDP

Nominal GDP

- Value of output produced in current year prices

- formula = price x quantity

- Can increased from year to year if either output/prices increase.

Real GDP

- Value of output produced in constant base year prices

- Formula = price x quantity

- Can increase from year to year if only the output increases

Also:

- In the base year, current price will always be equal to constant price

- In base year nominal and real GDP are the same

- In the years after the base year, nominal GDP will exceed real GDP

- In years before base year, real GDP will exceed nominal GDP

GDP Deflator

- Price index used to adjust from nominal to real GDP

- In base year GDP deflator will always equal 100

- For years after base year, GDP deflator is greater than 100

- Years before base year, GDP deflator is less than 100

- Formula: nominal GDP/ real GDP x 100

Consumer Price Index (CPI)

- Measures inflation by tracking changes in the price of a market basket of goods.

- Formula = Price of Market Basket in current year / price of market baskets in base year x 100

Subscribe to:

Comments (Atom)